This week I want to take a bit of a detour to discuss the problem of debt, and explore what it says regarding our value of money.

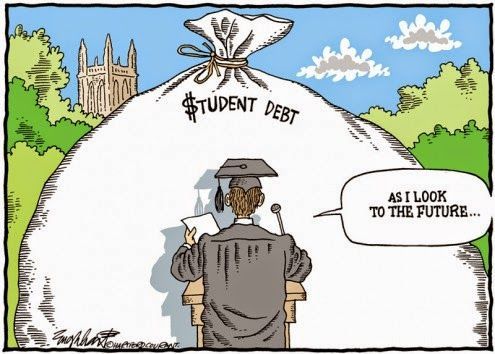

Recently I had a conversation with one of my fellow classmates who suggested that maybe people choose a college major because of the debt that comes from pursuing a college degree. An interesting thought, that I believe is worth exploring.

From Forbes, contributor Zack Friedman writes, “Student loan debt is now the second highest consumer debt category – behind only mortgage debt – and higher than both credit cards and auto loans”(Friedman). Furthermore he goes on to explain “the average student in the Class of 2016 has $37,172 in student loan debt” with over 44 million people borrowing (Friedman). Wow. Let that number sit. US News Allie Bidwell writes, “research has shown the average bachelor’s degree holder takes 21 years to pay off his or her loans. Under federal income-based repayment options, remaining debt is forgiven after 20 years”(Bidwell). There is clearly a problem.

From this data it makes perfect sense why you would choose to pick a major that could cover the college debt, but unfortunately the debt doesn’t stop there.

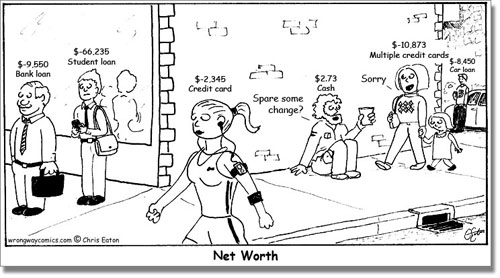

From Business Insider “The total amount of consumer debt in the US is nearly $2.4 trillion in 2010. That’s $7,800 debt per person”; “The average credit card debt per cardholder is $5,100…”; and “1 in 50 households carry more than $20,000 in credit card debt. That amounts to more than 2 million households”(Business Insider). To put that in perspective $2.4 trillion dollars is enough to put 42,857,142 students through a 4 year education in California. Read more info here.

So why do we just live in debt. I would argue that most people, generally, do not want to be living in debt and that it is by no means the norm.

So I understand the dilemma people are faced with. I need to choose a major that will provide me with a substantial income to avoid all this debt. However, it is slightly ironic that even in pursuit of this degree that will help you avoid this situation, you are accumulating more and more debt. You need a car, you need a house, food, phone, etc and the costs add up. I’m not saying these things are not valuable and I agree they are necessary, but when the objects in themselves become so important we have missed something. I believe our desire for money is commenting on something we as humanity desire way more. Let’s explore beyond a college major and talk about our general value of money.

Consider the advertising industry. PhD Art Markman from Psychology Today writes, “The problem is that we allow advertisers to have access to our mental world. They have paid for the opportunity to slip information to us about what feels good. That information ultimately affects the way we make choices, whether we know it or not”(Markman).

For a moment let’s ponder the things you buy and the things you want may be being manipulated by something or someone we never recognized. I argue that the continuous debt we live in, often points to something we are trying to have that money can’t buy. What are those things? Stay tuned until next week in my issue series.

Works Cited:

Articles are linked

Images are from: https://images.google.com/

I really enjoyed your brief overview of student debt (and debt in general) and how it affects people’s lives. I honestly am not surprised that the average amount of student debt is around $37,000. If anything, I thought it would be more. I have heard and read about stories of people who never even get around to fully paying off their debt and that is just absurd to me. I think that the issue of student debt leads into a much larger discussion of college tuition and whether or not college should be more affordable/free or not. But since that is not the topic of your post, I won’t get too much off topic. I liked that you brought up car loans, mortgages for houses, and other facets of life where debt is accumulated as well. It seems as though many are living in perpetual debt, which really is an odd thing to view as normal.

LikeLike

It is really sad that more and more often people are choosing majors that they are not really interested in order to cover the cost of overwhelming college debt. As a country we should make it easier for students to go school yet, the cost of tuition increases every year. We are at the point where we cannot ford to follow our dreams; we are forced to choose a major that will allow us to have financial security in the future. Honestly as a college student I continuously find myself hoping that all this debt I’m accumulating is going to be worth it one day!

LikeLike