Beyond “More Stuff”

Over the entirety of my posting I have focused heavily on why money is a poor sole influencer in regarding decision making. Last week I unpacked that idea that money and acceptance don’t belong together (ironically). From looking through some coca-cola adds you could clearly see that big corporations are convincing you to buy their product for a claim they cannot fulfill. For example, “open coke, open happiness” was the catchphrase that came up last time. However, with the right value of money now established (a tool) I want to transition the issue series to a more positive connotation. If money can’t buy love and acceptance, let’s talk about some meaningful things that money can buy and some useful ways to spend it. Overall how do we use money as an effective tool?

Let’s all be honest that spending money feels good. There is some novelty of walking into a store, seeing something you want, and having it in your hand after a simple transaction. From Independent, science editor Steve Connor writes, “Scientists have discovered that thinking about cash stimulates the reward centers involved in pleasure and the higher the salary – even if it is just imagined – the greater the pleasure generated in the brain.” Even by thinking about money, your brain starts to experience the potential reward. So think about it from the perspective of an advertising company. They know for you, as the consumer, it feels good to spend. They just need to convince you that you need their particular product and your natural inclination will do the rest.

Let’s all be honest that spending money feels good. There is some novelty of walking into a store, seeing something you want, and having it in your hand after a simple transaction. From Independent, science editor Steve Connor writes, “Scientists have discovered that thinking about cash stimulates the reward centers involved in pleasure and the higher the salary – even if it is just imagined – the greater the pleasure generated in the brain.” Even by thinking about money, your brain starts to experience the potential reward. So think about it from the perspective of an advertising company. They know for you, as the consumer, it feels good to spend. They just need to convince you that you need their particular product and your natural inclination will do the rest.

Pscyguides.com writes, “As they shop, their brain releases endorphins and dopamine, and over time, these feelings become addictive.” Follow the trail of logic. It feels good to spend, so you buy again, but the final expense never seems to come to an end.

Staff writer, Susan Kelleher, from the Seattle times writes, “The people throwing their stuff away might feel relieved, finally getting it out of the house. Whatever joy it once sparked is long gone, and the most pleasurable aspect of owning stuff — the moment just before you bought it — is but a distant memory.” The initial anticipation and thought of buying feels great, but the thing itself only brings a certain level of satisfaction. So what are some things you can’t buy? Memories and experience.

Staff writer, Susan Kelleher, from the Seattle times writes, “The people throwing their stuff away might feel relieved, finally getting it out of the house. Whatever joy it once sparked is long gone, and the most pleasurable aspect of owning stuff — the moment just before you bought it — is but a distant memory.” The initial anticipation and thought of buying feels great, but the thing itself only brings a certain level of satisfaction. So what are some things you can’t buy? Memories and experience.

From npr.org Allison Aubrey discusses spending money for time and not more stuff. She is quoting research from the Proceedings of the National Academy of Sciences which can be found in the link listed. Aubrey on Elizabeth Dunn, a professor of psychology at the University of British Columbia and an author of the study, quotes, “‘Buying yourself out of [tasks] like mowing the lawn or cleaning the bathroom — these were pretty small, mundane expenditures, and yet we see them making a difference in people’s happiness,’ Dunn says.”

Consider this example. You have $50 dollars in your wallet on a warm Saturday afternoon. A brand new video game, outfit, or item has just been released. As you are about to leave home you receive a phone call from a group of friends saying “hey we are headed to the beach! You want in?” You consider your options. Well I really wanted this thing and had planned to spend the day cooped up inside (I know we’ve all been there don’t deny it) but sure! They tell you it’s gonna be $25 dollar for gas and $25 dollar for lunch and dinner later on. A little concerned that you can no longer have the thing you want, you agree and go. And what happens? You have a blast! You’ve chosen friends instead of things; you’ve chosen experience instead of stuff; and you’ve chosen relationship instead of seclusion.

Consider this example. You have $50 dollars in your wallet on a warm Saturday afternoon. A brand new video game, outfit, or item has just been released. As you are about to leave home you receive a phone call from a group of friends saying “hey we are headed to the beach! You want in?” You consider your options. Well I really wanted this thing and had planned to spend the day cooped up inside (I know we’ve all been there don’t deny it) but sure! They tell you it’s gonna be $25 dollar for gas and $25 dollar for lunch and dinner later on. A little concerned that you can no longer have the thing you want, you agree and go. And what happens? You have a blast! You’ve chosen friends instead of things; you’ve chosen experience instead of stuff; and you’ve chosen relationship instead of seclusion.

Now I know we all need those days to be alone. They are important and refreshing. However, you know the difference. From weforum.org Paul Assistant Professor Paul Piff and graduate student Angela Robinson discuss the idea that the wealthy rely on their money when it gets tough, but the poor rely on other people. Now while this is an extreme example it reflects the values associated with having a lot of money. Money gives you a false sense of power and security. Using money is a tool to deepen the relationships around you and to create more opportunities to spend time together is a fantastic way to use it.

Think about others. Spend the money on the plane ticket to see your family. Spend the money for a concert and treat your significant other out to a nice date. Spend money to give to someone who doesn’t have as much as you. Money can be a great tool to help and be around others when your world isn’t all about you.

Works Cited:

Images are from google images

Articles are linked

Money and Acceptance

Last week I established that there is a divide about to what extent we should value money, and also discussed how when we make purchases, we are buying more than a product. This week I am going to discuss the relationship of spending for acceptance and to be a part of group.

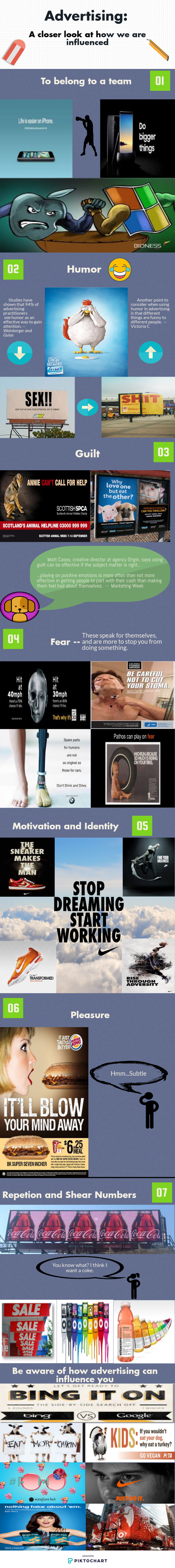

Have you ever been manipulated? Or even worse have you been manipulated by someone you deeply trusted. Someone that you believe to have your best intentions at heart, but was in reality using you. I’m sure most of you can relate. However, what if you were being manipulated and weren’t aware? Or even if you were slightly aware you didn’t realize to what extent. Welcoming to the world of advertising.

Consider this advertisement:

When was the last time you opened a bottle of happiness? Also pay careful attention to how you have the sun rays beaming down on the coca-cola bottle. The majestic green field that you could frolic through joyfully as you sip pure sunshine through the bottle. Sign me up.

However, no company would write: “open a Coke, open happiness” with this image.

Now why? They are the same thing! But you, as do I, feel differently about both. One makes you think I need a coke right now that sounds amazing, while the other makes me think I’ll never buy another. So you’re not really buying coke. You’re buying something else. Let’s keep building on this idea.

Consider another advertisement. Similar, but slightly different.

What is the intended response here. As C.S. Lewis would put it, the advertiser is trying to make you a part of something (Lewis). Your choice to donate makes you part of an elite group that sacrifice their finances to be a part of something greater. You are not buying a product you are buying belonging.

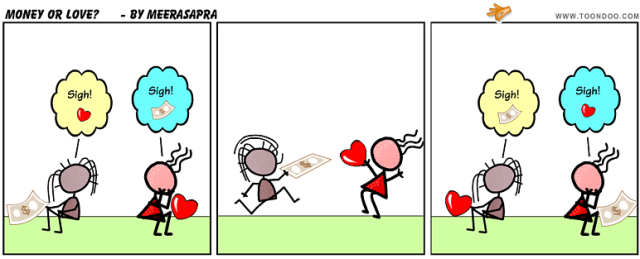

From the Journal of Marriage and Family, Edith Neisser writes,

“On a deeper level the possession or the spending of money may take the place of love.30 This is particularly likely to happen to young adults on their own for the first time. Some may be come extremely frugal, because funds in the bank represent emotional even more than financial security. Others spend more than they should, lavishing unnecessary luxuries on themselves, as if they were giving themselves the affection others seem to be denying them”

The first sentence of Neisser’s quote strikes the issue when she writes, “spending to take the place of love”. Can you buy it? Can you really ever spend enough to get there? Why is it that we are on the 10th generation of iPhones we are all still buying another?

I argue the fundamental manipulation that occurs is we believe advertisers have our best interest at heart. We believe that they are genuinely looking out for our best interest, and want to help us. While this may be true of some I believe we must face a reality that we know to be true, one that I even have a hard time writing. It’s a business. They want you to buy their thing, and they want to convince you that their thing is better than anyone. You can’t buy the love and the happiness that coca-cola wants you to think you can. But you are able to keep buying their stuff.

Let’s consider a final ad:

The companies are all competing. Who are they competing for? You. They are working in anyway to convince you to buy your thing, by whatever means necessary. However they have to appeal to you, they will do. From the Federal Trade Commision they write about the techniques of advertising. Let me list some concerning ones:

The companies are all competing. Who are they competing for? You. They are working in anyway to convince you to buy your thing, by whatever means necessary. However they have to appeal to you, they will do. From the Federal Trade Commision they write about the techniques of advertising. Let me list some concerning ones:

- Must-have→ Suggesting that you must have the product to be happy, popular, or satisfied.

- Fear→ Using a product to solve something you worry about, like bad breath.

We are all human, we have a fundamental need for belonging. Concerning the value of family Kathryn Parry from Health Guidance writes,

“During hard times, everyone in the family including you benefit due to the extended relationship, especially during events such as death, accident and so on. Also, the joy associated with success or any other happy moment magnifies when our family is around.”

Stop spending money to fill a void of belonging, that money was never meant to fill.

Works Cited:

Neisser, Edith G. “Emotional and Social Values Attached to Money.” Marriage and Family Living, vol. 22, no. 2, 1960, pp. 132–138., doi:10.2307/347329.

*The thoughts and inspiration for this blog post came from class discussion and also from C.S. Lewis’ book Mere Christianity in a small section of how buying habits are influenced.

What can money buy?

The issue: Is money really buying what we want it to buy?

Imagine you’re a child. Your dad is your hero. You think the world of him and aspire to be like him someday. You run up to him grab him by the pant leg and exclaim can we play can we play?! Eager to spend every waking moment with him by your side; him noticing what you are doing, congratulating you in your success and picking you up when you fall. Awaiting his reply you gaze up at him hopeful and excited. But barely sparing a glance he says not now I have to work. “But dad it’s Saturday! You’ve been gone all week!”.

He walks into his office shuts the glass door, which is almost mocking piece of furniture because you can see the emptiness in the pile of work that surrounds him. Things didn’t always used to be this way, you remember. You used to spend time as a family every night, eating dinner, laughing and reminiscing.

But promotion after promotion dad felt further and further away. The size of our house multiplied while the quality of time together vanished. Money used to be a tool for the family to enjoy, but it had grown now into the only thing that brought him satisfaction. The world around him told him to spend and spend, for him only to discover that he was after something money couldn’t buy.

To some degree, we are all going to make money. We need to know how to use it effectively, and how people are manipulated by it.

According to Money After Graduation, “If you have a bachelors degree you will earn approximately $1.8 million in your lifetime” and have about $1.5 million to actually spend (Casey). So what do we do with that money? Do we keep seeking more and more of it, like in the hypothetical example above at the expense of people we love? Or if we re evaluate the things we value most, can we use money as an effective tool.

This question lead me to do a bit of research on some things that money won’t give you. From Power of Positivity 10 things money can’t buy are, “Love, truth, time, peace, talent, health, manners/class, true friends, knowledge, presence and acceptance”(Power of Positivity). Now there are few elements in this source that I will be focusing on to discuss in my issue series: money trying to buy love and acceptance, and also, time and peace (Power of Positivity). As discussed by Professor Ching from UC Davis, advertising companies appeal to fear of missing out, and other elements of pathos, to get you to buy their product (Ching). What if there is another option?

This question lead me to do a bit of research on some things that money won’t give you. From Power of Positivity 10 things money can’t buy are, “Love, truth, time, peace, talent, health, manners/class, true friends, knowledge, presence and acceptance”(Power of Positivity). Now there are few elements in this source that I will be focusing on to discuss in my issue series: money trying to buy love and acceptance, and also, time and peace (Power of Positivity). As discussed by Professor Ching from UC Davis, advertising companies appeal to fear of missing out, and other elements of pathos, to get you to buy their product (Ching). What if there is another option?

To really define the issue, people value money more for the power, security, and comfort* they think it brings rather than using it as a tool for the things that are most important in their life. People wouldn’t flat out say this, but our spending habits indicate otherwise. From New York Magazine, Lisa Miller writes, “…that living high on the socioeconomic ladder can, colloquially speaking, dehumanize people. It can make them less ethical, more selfish, more insular, and less compassionate than other people”(Miller). The fundamental issue is that we need money, but to what extent.

That is where the disagreement lies. In the nation that we live in I argue that the narrative is largely the more stuff you have, the more meaningful of a life you have. The bigger house, the bigger indicator of success. My goal is to make the reader aware and re-evaluate our value of money. In my issue series I will unpack the things that we are actually attempting to buy with our finances (listed above) and also discuss more meaningful ways our money can be used. Lastly I want to flip the way we make purchase. Instead of buying things to fill a need for love and acceptance, how can you use money as a tool to expand your meaningful relationships; instead of accumulating massive stacks of money for security, how can you internalize peace where money isn’t anxiety producing.

That is where the disagreement lies. In the nation that we live in I argue that the narrative is largely the more stuff you have, the more meaningful of a life you have. The bigger house, the bigger indicator of success. My goal is to make the reader aware and re-evaluate our value of money. In my issue series I will unpack the things that we are actually attempting to buy with our finances (listed above) and also discuss more meaningful ways our money can be used. Lastly I want to flip the way we make purchase. Instead of buying things to fill a need for love and acceptance, how can you use money as a tool to expand your meaningful relationships; instead of accumulating massive stacks of money for security, how can you internalize peace where money isn’t anxiety producing.

Stay tuned for next week as we discuss the relationship of money between love and acceptance.

*this was inspired by another post I read, but cannot find the source.

Images are from Google Images

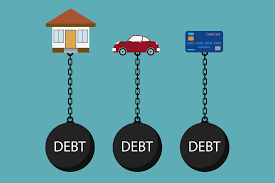

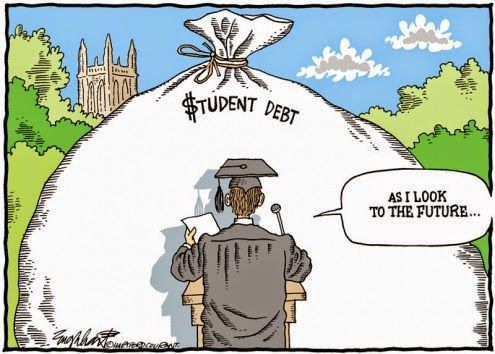

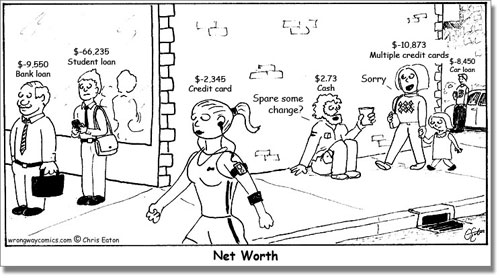

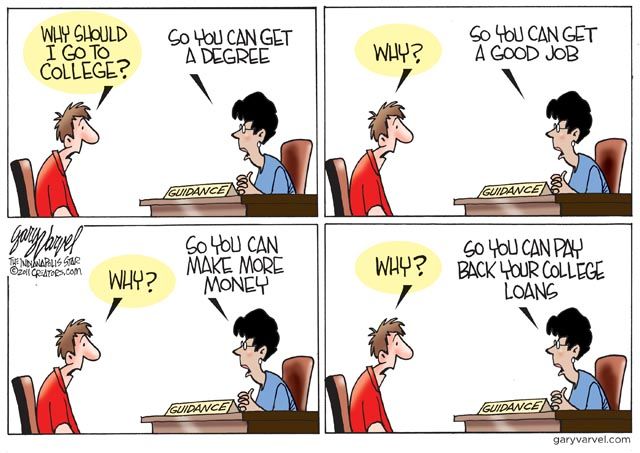

DEBT

This week I want to take a bit of a detour to discuss the problem of debt, and explore what it says regarding our value of money.

Recently I had a conversation with one of my fellow classmates who suggested that maybe people choose a college major because of the debt that comes from pursuing a college degree. An interesting thought, that I believe is worth exploring.

From Forbes, contributor Zack Friedman writes, “Student loan debt is now the second highest consumer debt category – behind only mortgage debt – and higher than both credit cards and auto loans”(Friedman). Furthermore he goes on to explain “the average student in the Class of 2016 has $37,172 in student loan debt” with over 44 million people borrowing (Friedman). Wow. Let that number sit. US News Allie Bidwell writes, “research has shown the average bachelor’s degree holder takes 21 years to pay off his or her loans. Under federal income-based repayment options, remaining debt is forgiven after 20 years”(Bidwell). There is clearly a problem.

From this data it makes perfect sense why you would choose to pick a major that could cover the college debt, but unfortunately the debt doesn’t stop there.

From Business Insider “The total amount of consumer debt in the US is nearly $2.4 trillion in 2010. That’s $7,800 debt per person”; “The average credit card debt per cardholder is $5,100…”; and “1 in 50 households carry more than $20,000 in credit card debt. That amounts to more than 2 million households”(Business Insider). To put that in perspective $2.4 trillion dollars is enough to put 42,857,142 students through a 4 year education in California. Read more info here.

So why do we just live in debt. I would argue that most people, generally, do not want to be living in debt and that it is by no means the norm.

So I understand the dilemma people are faced with. I need to choose a major that will provide me with a substantial income to avoid all this debt. However, it is slightly ironic that even in pursuit of this degree that will help you avoid this situation, you are accumulating more and more debt. You need a car, you need a house, food, phone, etc and the costs add up. I’m not saying these things are not valuable and I agree they are necessary, but when the objects in themselves become so important we have missed something. I believe our desire for money is commenting on something we as humanity desire way more. Let’s explore beyond a college major and talk about our general value of money.

Consider the advertising industry. PhD Art Markman from Psychology Today writes, “The problem is that we allow advertisers to have access to our mental world. They have paid for the opportunity to slip information to us about what feels good. That information ultimately affects the way we make choices, whether we know it or not”(Markman).

For a moment let’s ponder the things you buy and the things you want may be being manipulated by something or someone we never recognized. I argue that the continuous debt we live in, often points to something we are trying to have that money can’t buy. What are those things? Stay tuned until next week in my issue series.

Works Cited:

Articles are linked

Images are from: https://images.google.com/

The Right Lens

The focus in my blog post this week will be how money can convolute the lens in which we see the world around us, the major we would like to have, and the career we will one day end up choosing. In my previous posts I have explained to you how I arrived at religious studies. It was a major where I felt heard and also had the opportunity to listen to other people’s thoughts and question about life. I was more myself and wasn’t focused on who I wanted to be in the future. Paired with other things going on in my life, I was more focused in who I was at the moment. I started pursuing an education that I had a passions for despite the continuous looks of concern.

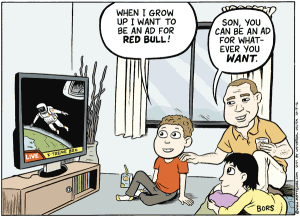

“Peter Whybrow, of the Semel Institute of Neuroscience and Human Behavior, contends we are hard wired to seek the rewards of money and possessions. We get things and money dopamine is released, the same chemical released when consuming caffeine and cocaine. So capitalism, with its unrivaled ability to generate wealth, becomes addictive; yet as with any addiction, there is a price to be paid. This cost is illustrated in frayed relationships, families, and friends sacrificed to the wheel of work and consumption”(Dobrin). Full article here.

Or more simplistically put:

Now I have been known to be a big dreamer. I often to commit to things way to quickly without even beginning to think about the practicality. Once I joined a club on campus, had an interview, got accepted, and then dropped out four days later when I realized how much work was required. Why am I telling you this you may ask, well here is why! Money is not something I usually factor into my decision making.

But let me tell you a story that caught me off guard. My fiancé shared with me this week that she got an email about a program called Teach for America, and I immediately passed the idea off because in my head it didn’t make enough money. Half of you reading this are saying to yourself oh my what have you done, while the other half of you are men. Don’t worry it gets worse. I also got the same email but hadn’t checked it yet. Fast forward a day and I go to her full of excitement about this exciting new career opportunity once I had learned it made a decent salary! “Butthead” her words.

She is completely right. Now if we can all move past my poor listening skills and selfishness in this situation we can move to a bigger problem. I immediately wrote off an opportunity

because of the salary. In relation to Dobrin’s article he writes, “A fulfilled and meaningful life cannot exist outside of a relationship. You are who you are because you are related to something outside yourself. So the question isn’t whether to be related or not, but what you are related to and how”(Dobrin). Now I by no means was choosing money over my relationship, but money, indeed, was something I was beginning to relate too closely to. To not even consider something of great value, and frankly something I love and am good at, because of the number on a screen.

In an article from the New York Times, Phyllis Korkki writes,

“‘Many people want to make a lot of money, but the benefits of having a high income are ambiguous,’ said Professor Kahneman, who is also a Nobel laureate in economics. When you are wealthy you are able to buy more pleasures, he said, but a recent study suggests that wealthier people ‘seem to be less able to savor the small things in life’”(Korkki)

First of all NOBEL LAUREATE IN ECONOMICS says money isn’t everything. Second it is important note that the article has a favorable view of money. That we need it an without we can be in real hardship (Korkki). But an even greater thing to be aware of is the line “…less able to savor the small things in life”(Korkki).

Money as a tool is great. But money as a god fails. It becomes something to obsess over and something that skews our perception of what is important. An article written by Jeffrey James from Life in Charge gives an explanation of money:

- “Money as a means: We can afford to go, even if it means hitting our savings target a month late. We only get so many relatives, but we can always make more money.

- Money as an end: We can’t afford to go because it would mean dipping into our savings. We would love to go but it’s just not in the budget right now”(James).

While the latter seems rational, it is the beginning of a set of small decisions that begin to put money ahead of people that are dear to us.

We limit our scope because of our focus on money. A valuable lesson, as Jeffery James explains well, “It is a tool. Nothing more. Don’t confuse money with the important things in your life”(James).

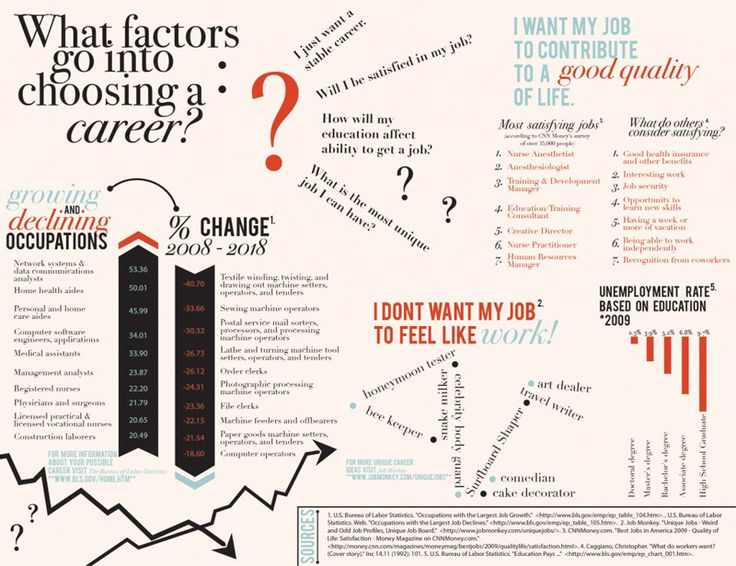

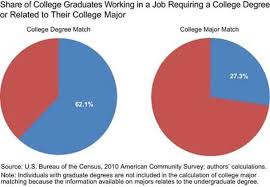

Does a Major = a Job?

The point of my post this week is I want to talk about what are employers are looking for from college graduates, and exactly how helpful is our college degree. Also, I want to consider how when we don’t fixate our gaze upon money, we end up being rich. As I explained last week, I arrived at UC Davis ready to tackle the medical field. Four years later, I am preparing to leave Davis with hardly an idea of exactly what I like to do. However, don’t panic there is hope. When I decided I was not going to be a doctor I changed to something that I enjoyed, French. Most of you probably just slapped your hand to your face and thought what have you done. Honestly, I think sometimes I still think that too. Wouldn’t it be easier I just chose something that had practical application and was going to provide a guaranteed job? However, that doesn’t sit quite right with me either. I didn’t decide what I would be studying until I was a junior in college. Religious Studies. My favorite response I have received over the past 2 years to telling people my major is, “Oh really” with a look of concern “what do you plan to do with that?” As though at age 21 I know every moment of my life until 60.

Now before you write me off, let’s consider some facts. Ashley Stahl, a contributor from Forbes, writes an article titled Six Reasons Why Your College Major Doesn’t Matter. [You can find the image in the link provided] Yes I realize what I just wrote, but humor me. Stahl writes, “According to recent research, 62% of recent college graduates are working in jobs that require a degree, yet only 27% of college graduates are working in a job that even relates to their major”(Stahl). That number hopefully provides some ease to the pressure of having to choose a major that will lead to success. She goes on to explain that often our college degree is more of a “prerequisite” but by no means the final qualifier (Stahl). Most importantly, to which I agree with, that who you know, and the unique skills that you bring in as an individual, are more pertinent to your success; specifically, “You’re a better performer when you are aligned with your purpose”(Stahl). I realize that this is sort of a radical idea, and almost blasphemous to students currently at University, however, it is important for us to be open to the idea that maybe our college degree doesn’t have as much of a lead into our future career as we would like to think.

I want to be careful to not discredit anyone’s education, remember that I am a student at University as well, but it is important to know what employers are looking for. USA Today College explains that GPA influences whether or not you can get an interview, but does guarantee a job (USA Today College). I mean the headline from the Association of American Colleges and Universities literally writes, “While you may think that choosing the ‘right’ major is key to getting a good job, your long-term professional success will depend far more on acquiring the right skills for a rapidly changing workplace”(Association of Colleges and Universities). The key to successfully choosing a major, or even a lifestyle, is not how do I make the most money but, as their website explains, how do I learn to communicate effectively, work in a team, operate honestly, and think creatively (Association of Colleges and Universities). It is almost ironic. When we seek money and success it never really comes, but when we do the things that we, as human beings, were created to do, we end up being successful and fulfilled.

It’s not really feasible to measure happiness, because it is such a fleeting, changing emotion and also varying for different people, but Kevin Loria, business insider from indepent.co.uk explains by science, nine things that happy people have in common. They value relationships, time, they slow down, show acts of kindness, exercise, have fun, stay in the moment, and spend time with friends (Loria). Now you may have noticed that I only listed 8 things because the 9th facet he explains is around money. He writes, “People’s well-being rises along with income levels up to an annual salary of about $75,000”(Loria). This was something I talked about in my last blog post. Money provides some happiness, but only to a certain extent. However, and more importantly, it is one of nine. The article does not say we need a billion dollars, but rather emphasizes we need real, genuine human interaction. There is indeed a reality of needing money, but how we define need is important. As young college students it is important to begin to consider, what really is going to lead to a more fulfilling life. If anything is clear, money is not the answer.

Money in the Driver’s Seat

In this weeks blog post I want to talk about the idea of choosing a college major for financial income. Choosing a major for how much money or power it will bring, is a bad decision. When I was 17 I came to UC Davis orientation in full confidence that I would be a neurosurgeon, while in reality, I had a slight crush on Derek Shepherd from the television show Grey’s Anatomy. I browsed the UC Davis catalog and picked something that had the word biology in it. That’ll do it I thought, I’m on track to be a doctor! Now what I really was enticed by was Dr. Shepherd’s success. I could see that he was the man, and I wanted to be the man. The way he commanded the hospital and had everyone’s respect was something I was reaching for. I loved the thought of being a doctor, but when reality smacked me in the face sitting through the Chem series, I quickly discovered this wasn’t something for me. I clang to that dream making every effort to convince myself this was it, but I felt like a square puzzle piece trying to fit into a circular hole. I wasn’t enjoying my experience and certainly couldn’t envision myself doing this for the next 50-60 years. Now I am not suggesting that everyone comes into college in an identical fashion to mine, but I will argue that we are often shaped by outside systems of what we are told to be. What will make the most money, provide the most security, and make you the most famous are idealized. So, should you choose a major for money? Well let’s look more closely. In an article written by Belinda Luscombe from Time Magazine reports data concerning happiness and wealth. She writes, “But no matter how much more than $75,000 dollars people make, they don’t report any greater degree of happiness”(Luscombe). Now, I am not suggesting that $75,000 is a small earning by any means, but what I do want to highlight is that happiness from money has a limit. From the documentary titled Minimalism they quote actor Jim Carrey who states, “I think everybody should get rich and famous and do everything they ever dreamed of so they can see that it’s not the answer”(Carrey).

To make this blatantly clear, Jim Carrey’s net worth is $150 million and this is his advice. To build upon this idea, in an article from Forbes, contributor Jacob Morgan explains his perspective on whether people should follow passion or money by writing through the lens of Dirty Jobs host, Mike Rowe. Morgan writes concerning Rowe’s ideology, “…he has a lot of non-conventional ideas about work, specifically his advice to ‘not follow your passion but to bring your passion with you to work’”(Morgan). Another astonishing fact from his article is that, from the Bureau of Labor Statistics, “…that there are around 5 million vacant jobs in the United States as of the end of October (not seasonally adjusted which brings these numbers down a bit)”(Morgan). This indicates the opportunities are clearly available, but people are disinterested. Therefore, I agree with Rowe that passion should not be defined by external circumstances, but rather be an internal driver to be able to work in any field. To conclude Rowe summarizes his belief well as Morgan quotes, “Passion is too important to be without, but too fickle to be guided by”(Morgan). So if we aren’t to follow money or our passion how do we begin to be guided by something that clearly doesn’t have longevity. How can you choose a major, or even a lifestyle for that matter, that is not obsessed with either? Well, From The Balance writer Dawn Rosenberg McKay summarizes it perfectly when she states, “Before you can choose the right career, you must learn about yourself. Your values, interests, soft skills, and aptitudes, in combination with your personality type, make some occupations a good fit for you and others completely inappropriate”(McKay). In order to make a decision of this magnitude, knowing oneself is critical. When I came into college, this was the first time that I had been living by myself, eating on my own, and not seeing my parents everyday. I really only knew who I was from the context of life with my parents. Rather than bombard young adults with academic information there should be increased requirements for students take classes to help them discover who they are. From CBS News, Lynn O’Shaughnessy reports that only 50% of public and private school students feel as though they got their money’s worth from their degree (O’Shaughnessy). Read her full article here. Instead of money being at the forefront of decision making, it would be more helpful to start students in classes where they can discover who they are as newly independent human beings. In following posts I will be discussing what getting to know oneself looks like through some examples of people who have been extremely successful, but started with nothing. Also I will be exploring what majors lead to what careers and how helpful each major really is.